Bank Statements and Finanace Blog

Bank Statements, Banking and Finance Blog

Learn more about Bank statements for many different banks on this blog. Read about other financial statements.

What is a Bank Statement?

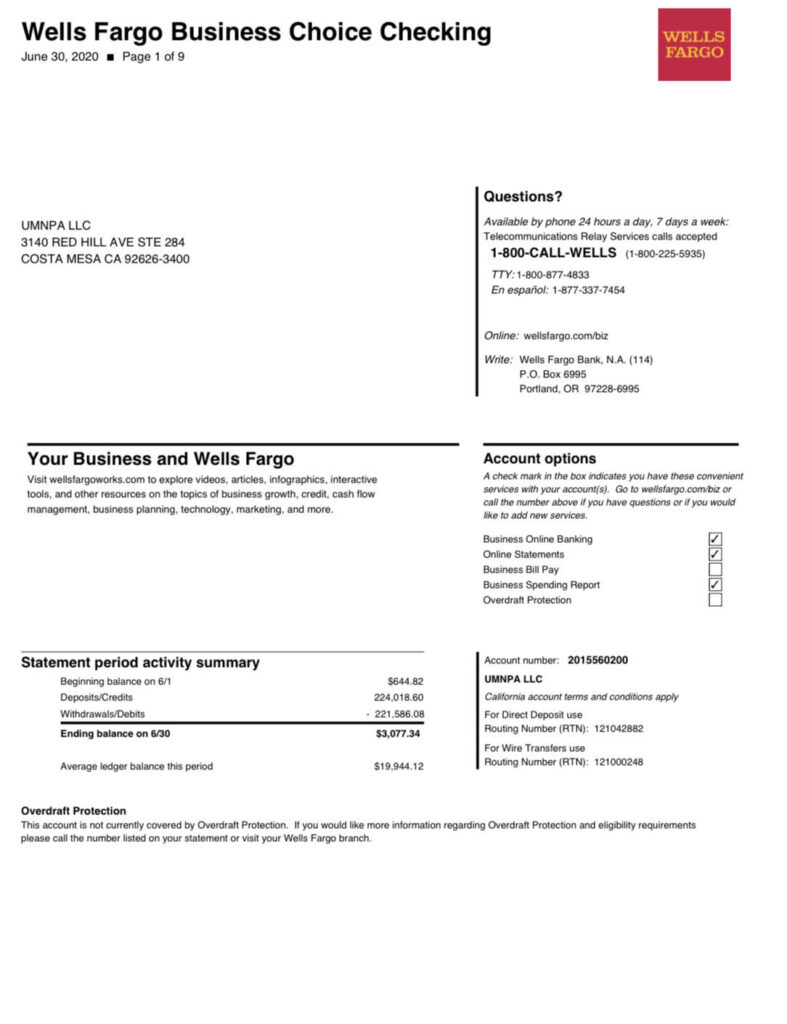

A bank statement is a record or report that provides a summary of all the financial activities and transactions that have taken place in an account over a given time frame, usually on a monthly basis. Banks and other financial organisations give it to account holders. The deposits, withdrawals, transfers, fees, and interest earned or paid on an account are all listed in detail on bank statements. The period’s beginning and closing balances are also provided by them.

What is the use of a Bank Statement?

One of the primary uses of a bank statement is to provide a detailed account of account activity. It carefully documents all financial transactions, including transfers, withdrawals, and deposits, providing users with an overview of how their money is being spent. Ensuring the security and integrity of one’s financial assets requires thorough tracking in order to spot any fraudulent or unauthorised activities.

Secondly, they are a great resource for financial planning and budgeting. People can receive insights into their spending habits, spot possible savings opportunities, and make well-informed budgetary decisions by examining the inflows and outflows of money. By taking a proactive stance, people are given the ability to take charge of their financial situation and work towards their financial objectives.

Bank statements also serve a crucial role in tax preparation. They provide a consolidated record of taxable income, deductible expenses, and other financial activities essential for accurately filing tax returns. This not only simplifies the tax filing process but also ensures compliance with tax laws and regulations.

For individuals seeking financial stability or applying for loans, bank statements act as proof of income and financial verification. Lenders often require these documents to assess the applicant’s financial health, repayment capacity, and overall creditworthiness. A well-maintained and accurate bank statement can significantly enhance one’s chances of securing loans or credit.

How to read a Bank statement

At first, reading a bank statement may seem difficult, but it gets simple if you know what the important details are. Here’s how to read a bank statement step-by-step:

Header Data: Look for your name, account number, statement period, and the bank’s contact information at the top of the statement.

Balances at opening and closing: Determine your account’s initial balance (the amount within at the start of the statement period) and closing balance (the amount remaining at the conclusion of the period).

Overview of Transaction: For an overview of all financial transactions made during the statement period, skim the transaction section. Generally, there are five categories for transactions: deposits, withdrawals, transfers, fees, and interest.

Transaction Information: Check every transaction line for specific information such as the amount, date, and description or story of the transaction. Observe any codes or references that the bank may employ.

Deposits: Determine your income streams, including direct payments from your employer, interest credited to your account, and salary deposits. Usually, these are mentioned as credits.

Withdrawals: Track down any withdrawals, such as cash taken out of ATMs, checks written out, electronic transfers, or other debits. Usually, these are shown as negative amounts.

Changes: Examine any transfers internal or external—between your accounts. Transfers to accounts in other banks may be indicated differently from internal transfers within the same bank.

Charges and Fees: Any fees or charges, such as overdraft, ATM, or monthly maintenance costs, that are imposed on your account should be understood. They are deducted from the amount in your account.

PAID or EARNED Interest: Verify any interest paid on loans or earned on deposit accounts. Generally classified as a separate item, interest can show up as a charge or credit based on the specifics of the transaction.

Running Equilibrium: A running balance is provided by certain bank statements following each transaction. This facilitates monitoring your account balance following each transaction.

Extra Details: Examine any other materials that have been supplied; these could include bank notes or communications that clarify particular transactions or offer significant updates.

Trends and Comparisons: Think about contrasting this statement with earlier ones to find any odd or surprising alterations. Examine your saving and spending patterns for patterns.

Internet Reach: Use mobile apps or internet banking, if available, to examine photos of cleared checks, obtain real-time account updates, and access more comprehensive information.

How to get a Bank Statement

To obtain a bank statement, individuals can leverage various channels based on their preference and the services offered by their bank. Online banking provides a convenient option, where users can log in to their account, navigate to the statements section, and either view or download the statement. Mobile banking apps offer a similar approach, enabling users to access statements on the go.

Additionally, Automated Teller Machines (ATMs) allow customers to print a mini statement or request a full account statement by following on-screen instructions. For those preferring a face-to-face interaction, visiting a bank branch and requesting a statement from a representative is a viable option. Customer service can be contacted via phone or online support, and some banks even accept statement requests through email. Lastly, enrolling in e-statements provides an automated and eco-friendly solution, delivering statements directly to the user’s email or online banking platform.

How long should I keep a Bank Statement?

Generally speaking, monthly bank statements should be kept for at least a year in order to facilitate budgeting and easy access. For a minimum of three to seven years, tax-related documents, such as income and deductible costs, should be kept on file. Consider retaining long-term records for as long as the accounts or obligations are active, particularly those related to loans, mortgages, or significant transactions. It is advisable to retain pertinent statements in the event of contested transactions until the matter is settled. Convenient and space-saving alternatives are provided by electronic statements, and protecting sensitive information is aided by safely shredding paper records before discarding them. It is a good idea to check local legislation as your area may have different requirements when it comes to keeping financial records. Always seek the advice of financial experts for specific recommendations based on your situation.

What peoples say about us

Read what our customers say about us.

Contact us today to get a document that will helo you get your leave from work or school.