Address

304 North Cardinal St.

Dorchester Center, MA 02124

Work Hours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

Address

304 North Cardinal St.

Dorchester Center, MA 02124

Work Hours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

0,00 $

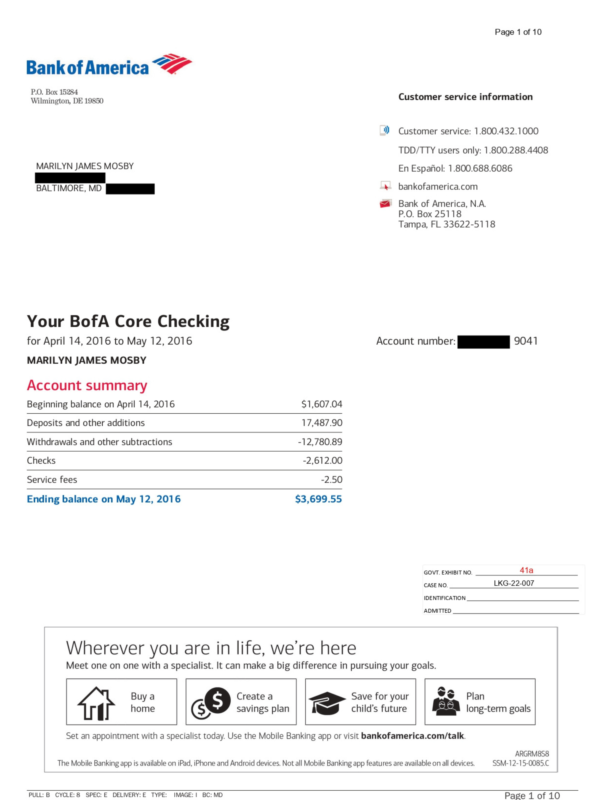

Purchase your high-quality fake bank statement and bank statement from Jaysonnotes Company at affordable prices.

A fake bank statement is a fabricated financial document that displays false information about an individual’s or entity’s financial transactions, account balances, and other financial details. People create fake bank statements to present lenders, landlords, government agencies, or other parties into believing that the individual or entity has a stronger financial position than they actually do. These documents can be used to inflate income, hide debts, misrepresent financial stability, or qualify for loans, credit cards, mortgages, or government benefits that the individual or entity would not otherwise be eligible for based on their true financial situation.

The motivations behind creating fake bank statements vary, but they often revolve around achieving unwarranted financial advantages or concealing financial losses. Individuals may produce fake bank statements to appear more creditworthy, qualify for loans, or access benefits meant for low-income individuals. On the other hand, businesses might manipulate bank statements to hide financial losses from investors or stakeholders, maintaining a facade of financial health to avoid losing trust or facing repercussions for poor financial performance.

People need 3 to 6 months of bank statements for various reasons, primarily when they apply for loans, credit cards, or rental leases. Lenders and landlords often request these documents to verify the applicant’s financial history, income, and financial stability. By reviewing these statements, they can assess the applicant’s creditworthiness, determine their ability to repay loans or rent, and identify any red flags, such as bounced checks, missed payments, or unusual transactions.

The following are some reasons why 3 to 6 months of bank statements are typically requested:

Creditworthiness assessment: Lenders need to evaluate an applicant’s financial history to determine if they can repay a loan. By reviewing bank statements, they can assess the applicant’s income, expenses, and financial stability.

Income verification: Bank statements serve as evidence of an applicant’s income, allowing lenders to confirm that they have a stable source of income to support loan repayment.

Expense analysis: Lenders analyze an applicant’s expenses to ensure they have enough disposable income to make loan payments. By reviewing bank statements, they can identify patterns in spending and determine if the applicant can afford the loan.

Red flag detection: Bank statements can reveal suspicious or unusual transactions, such as bounced checks or missed payments, which may indicate financial instability or fraud.

Financial stability: By reviewing several months of bank statements, lenders can assess an applicant’s long-term financial stability and make more informed lending decisions.

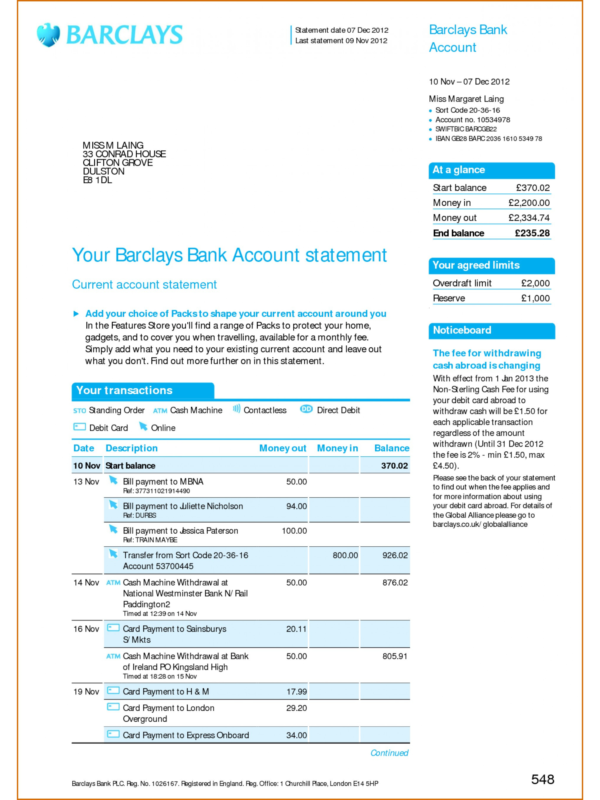

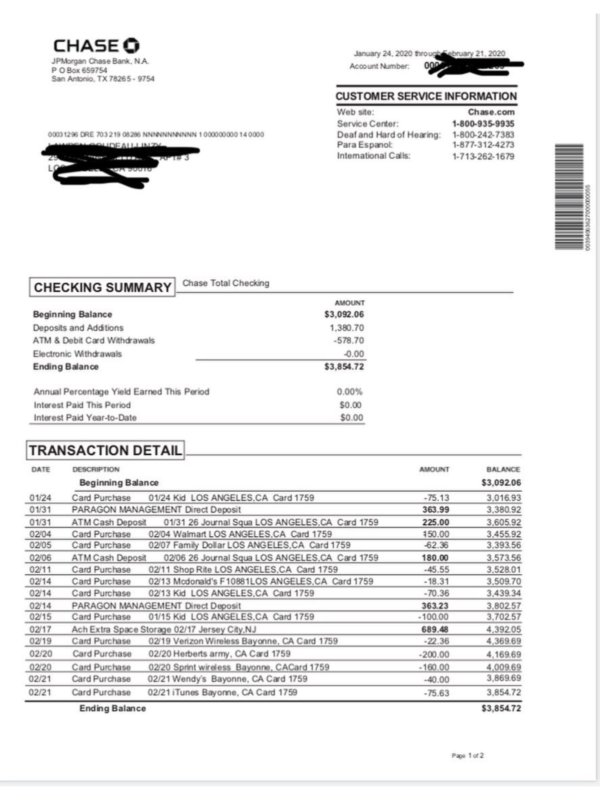

Parts of a bank statement include information about the bank, such as bank name and address as well as your information. The bank statement will also contain account information and the statement date, as well as the beginning and ending balance of the account. Details of each transaction notably the amount, date, and payee that took place in the bank account during the period will also be included, such as deposits, withdrawals, checks paid, and any service charges.

For example, a bank statement may show a non-interest-bearing checking account with a beginning balance of $1,050, total deposits of $3,000, total withdrawals of $1,950, an ending balance of $2,100, and zero service charges for the period Sept. 1 through Sept. 30.

Bank statements offer several uses to individuals, businesses, and financial institutions:

Loan and Credit Applications: Lenders and creditors often require bank statements as part of the application process for loans, credit cards, and other financial products. These statements help assess the applicant’s financial health and repayment capacity.

Record of Transactions: A bank statement provides a comprehensive record of all transactions related to a specific bank account. This includes deposits, withdrawals, transfers, purchases, and payments.

Tracking Expenses: Individuals can use bank statements to monitor their spending habits and track their expenses.

No, it is not necessary to make fake bank statements. In fact, it is almost always the worst option, because the risks and consequences are far greater than the problem it’s meant to solve.

In most situations where a bank statement is requested, there are legal and acceptable alternatives. Banks can issue official statements, balance confirmation letters, or stamped transaction histories. Employers, landlords, schools, and embassies often accept other documents such as pay slips, tax returns, sponsorship letters, affidavits, or explanations of financial circumstances if asked in advance.

People sometimes feel it is “necessary” because they fear rejection, are under time pressure, or do not know what alternatives exist. This feeling comes from stress and lack of information, not from an actual lack of options. Many institutions are willing to work with applicants who communicate honestly.

In short, while financial requirements can be difficult to meet, there is always a safer and legal path. If a bank statement is being requested and you cannot provide one, the correct step is to ask what other documentation is acceptable not to fabricate evidence.

Creating or using fake bank statements, whether for one month or six, is generally considered fraud and can carry serious legal and long-term consequences. Supplying multiple months actually increases the risk, because inconsistencies across dates, balances, or transaction patterns are easier to detect during verification.

Reviews

There are no reviews yet.