What is a Fake Bank Statement

A fake bank statement is a fabricated financial document that displays false information about an individual’s or entity’s financial transactions, account balances, and other financial details. People create fake bank statements to present lenders, landlords, government agencies, or other parties into believing that the individual or entity has a stronger financial position than they actually do. These documents can be used to inflate income, hide debts, misrepresent financial stability, or qualify for loans, credit cards, mortgages, or government benefits that the individual or entity would not otherwise be eligible for based on their true financial situation.

Why do people need fake Bank Statements

The motivations behind creating fake bank statements vary, but they often revolve around achieving unwarranted financial advantages or concealing financial losses. Individuals may produce fake bank statements to appear more creditworthy, qualify for loans, or access benefits meant for low-income individuals. On the other hand, businesses might manipulate bank statements to hide financial losses from investors or stakeholders, maintaining a facade of financial health to avoid losing trust or facing repercussions for poor financial performance.

Why do people need 3 to 6 months Bank statements

People need 3 to 6 months of bank statements for various reasons, primarily when they apply for loans, credit cards, or rental leases. Lenders and landlords often request these documents to verify the applicant’s financial history, income, and financial stability. By reviewing these statements, they can assess the applicant’s creditworthiness, determine their ability to repay loans or rent, and identify any red flags, such as bounced checks, missed payments, or unusual transactions.

The following are some reasons why 3 to 6 months of bank statements are typically requested:

Creditworthiness assessment: Lenders need to evaluate an applicant’s financial history to determine if they can repay a loan. By reviewing bank statements, they can assess the applicant’s income, expenses, and financial stability.

Income verification: Bank statements serve as evidence of an applicant’s income, allowing lenders to confirm that they have a stable source of income to support loan repayment.

Expense analysis: Lenders analyze an applicant’s expenses to ensure they have enough disposable income to make loan payments. By reviewing bank statements, they can identify patterns in spending and determine if the applicant can afford the loan.

Red flag detection: Bank statements can reveal suspicious or unusual transactions, such as bounced checks or missed payments, which may indicate financial instability or fraud.

Financial stability: By reviewing several months of bank statements, lenders can assess an applicant’s long-term financial stability and make more informed lending decisions.

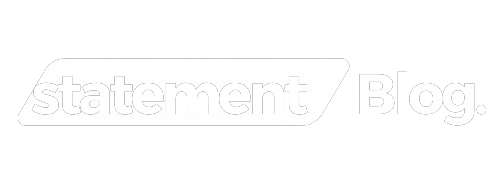

Wells Fargo Bank statement template

Reviews

There are no reviews yet.