Address

304 North Cardinal St.

Dorchester Center, MA 02124

Work Hours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

Address

304 North Cardinal St.

Dorchester Center, MA 02124

Work Hours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

0,00 $

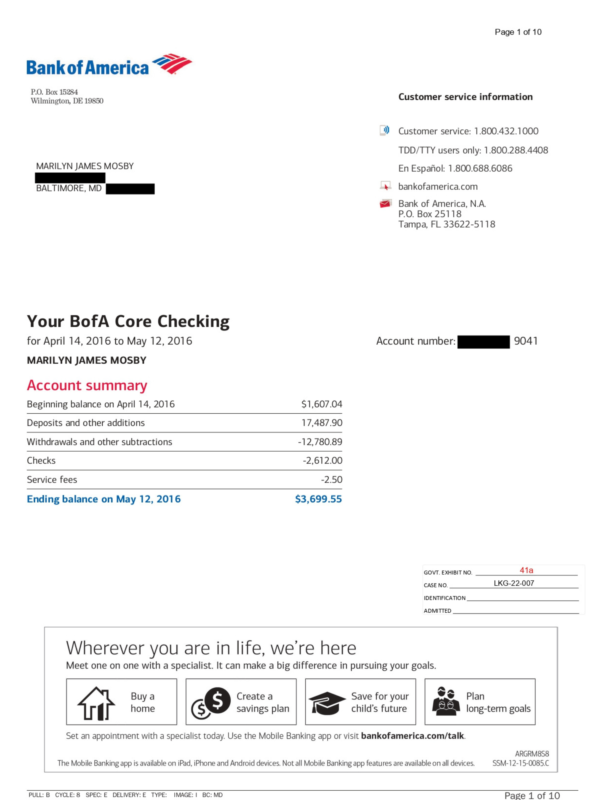

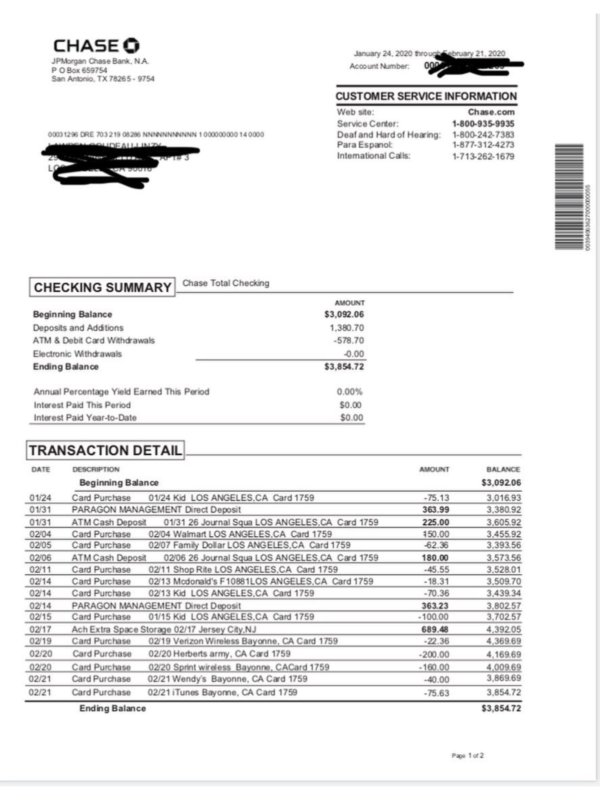

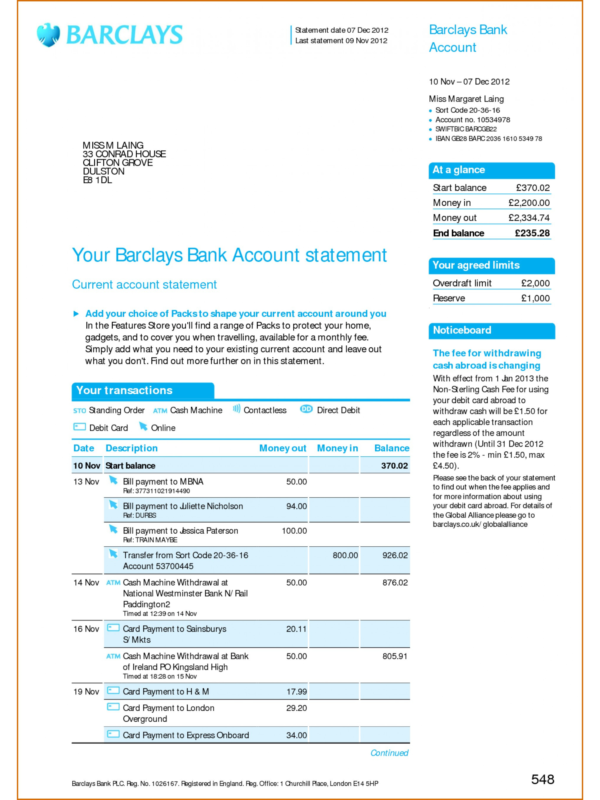

Buy 3 – 6 months of fake bank statements. To place an order, click HERE to contact us. We have the templates and accessibility to get your bank statements made fast. Click HERE to contact us.

Buy 3-6 months of fake bank statement at affordable prices. Banks, lenders, and other official offices often require applicants to provide at least 3 months’ worth of bank statements for various reasons, particularly when individuals or businesses apply for loans, credit cards, mortgages, or other financial products.

3–6 months of fake bank statements” usually refers to a set of multiple fabricated or altered bank statements that are made to look like they cover a continuous period of three to six months, rather than just a single month.

The following are some reasons why 3 to 6 months of bank statements are typically requested:

Creditworthiness assessment: Lenders need to evaluate an applicant’s financial history to determine if they can repay a loan. By reviewing bank statements, they can assess the applicant’s income, expenses, and financial stability.

Income verification: Bank statements serve as evidence of an applicant’s income, allowing lenders to confirm that they have a stable source of income to support loan repayment.

Expense analysis: Lenders analyze an applicant’s expenses to ensure they have enough disposable income to make loan payments. By reviewing bank statements, they can identify patterns in spending and determine if the applicant can afford the loan.

Red flag detection: Bank statements can reveal suspicious or unusual transactions, such as bounced checks or missed payments, which may indicate financial instability or fraud.

Financial stability: By reviewing several months of bank statements, lenders can assess an applicant’s long-term financial stability and make more informed lending decisions.

When someone says 3 to 6 months of Bank statement, they are typically talking about documents that:

Institutions often ask for 3–6 months of statements often in PDF to assess financial stability, spending patterns, income consistency, or savings history. Creating multiple months makes the documents look more “complete” or convincing than just one statement.

People usually mention “3–6 months” because that is a standard requirement for:

Rental applications

Providing several months is meant to show ongoing financial behavior, not a one-time snapshot.

Creating or using fake bank statements, whether for one month or six, is generally considered fraud and can carry consequences. Supplying multiple months actually increases the risk, because inconsistencies across dates, balances, or transaction patterns are easier to detect during verification.

Reviews

There are no reviews yet.